- Business confidence was shattered in the December quarter according to the latest NZIER survey. A record net 73% of firms see a deterioration in general economic conditions ahead.

- Demand in the economy is falling as expected trading activity fell to near GFC lows, and indicate a recession lies ahead.

- The current climate is simply not ideal for expanding business. With a dimming economic outlook, there’s a growing reluctance among firms to invest and hire over the coming year.

MPS appears to have spooked Kiwi businesses. The NZIER’s latest measure of business confidence hit an all-time low in the final quarter of 2022. A net 73% of firms see a deterioration in economic conditions ahead, a 30%pt jump on Q3. Looking underneath the headline confidence reading and the data points to tougher times ahead. Demand is falling, firms are looking to cut headcount, and yet inflation pressure in the economy remains acute.

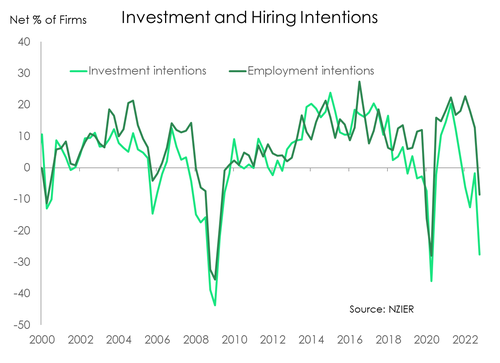

A net 33% of firms now see weaker domestic trading activity ahead, a reading that is near GFC lows. The reading supports our view that the economy is on track to experience a recession from the middle of the year. However, the sticker shock of the recent RBNZ’s move may have exaggerated some of the moves in NZIER’s reading in the December quarter. As firms anticipate weaker activity ahead, their plans change. Both investment and employment intentions fell. For the first time since late 2020  employment intentions showed some vulnerability. A net 6.3% of firms are looking to cut headcount in coming months. Labour turnover also fell sharply at the end of 2022 in a further sign that the heat is just beginning to come out of the labour market.

employment intentions showed some vulnerability. A net 6.3% of firms are looking to cut headcount in coming months. Labour turnover also fell sharply at the end of 2022 in a further sign that the heat is just beginning to come out of the labour market.

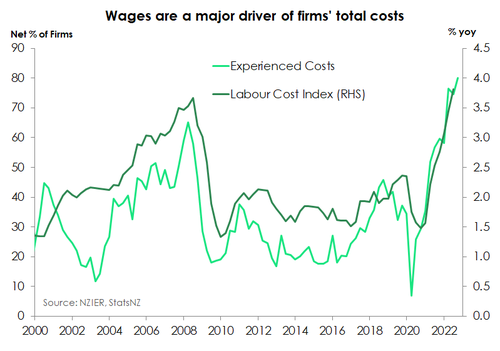

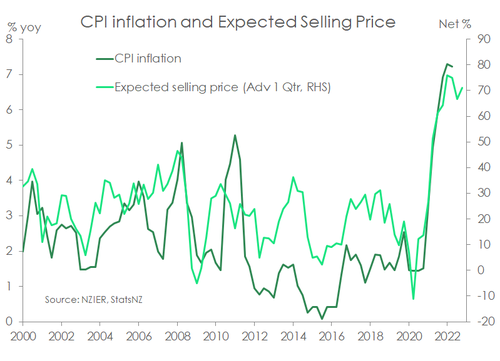

A worry for the RBNZ will be the persistent cost pressures and pricing intentions. Cost pressures have intensified, and are emanating from the labour market. Both experienced and expected cost readings hit survey highs, with a net 80% of firms experiencing rising costs. Despite deteriorating, overall demand remains high relative to the economy’s ability to meet it. Measures of capacity utilisation remain high and increased for non-exporters (such as builders). The non-tradables sector of the economy is the main engine of inflation at present. Rising costs are being passed onto customers. A net 71% of firms intend to lift prices in the coming quarter, that’s up a handful of points compared to September although still off highs hit at over the first half of last year. Elevated cost pressures in an environment of falling demand has dented firms’ outlook of profitability.

Today’s report supports our opinion that the RBNZ may deliver too much in the way of rate hikes and monetary tightening. The report may not be enough to alter the RBNZ’s view on delivering another 75bp hike in the OCR next month to 5%. Although we would advocate a lesser move (25, not 75). And financial markets are moving in favour of reduced rate hikes. The economic pendulum is clearly swinging towards downside risks, rather than upside risks. We continue to forecast a peak in the RBNZ’s cash rate in coming months, and a likely cut to that cash rate by year-end.

Today’s report supports our opinion that the RBNZ may deliver too much in the way of rate hikes and monetary tightening. The report may not be enough to alter the RBNZ’s view on delivering another 75bp hike in the OCR next month to 5%. Although we would advocate a lesser move (25, not 75). And financial markets are moving in favour of reduced rate hikes. The economic pendulum is clearly swinging towards downside risks, rather than upside risks. We continue to forecast a peak in the RBNZ’s cash rate in coming months, and a likely cut to that cash rate by year-end.

At odds with lower employment intentions, firms continue to face difficulty in finding the labour they need – particularly skilled workers. And a lack of workers is still the biggest constraint on demand, although falling demand is catching up. As a result, don’t expect the unemployment rate to rapidly rise anytime soon. Nevertheless, finding labour is likely to get easier over 2023. NZ’s net migration is now recording a net inflow of people, and we are forecasting a decent recovery in net mi over the year. Moreover, the demand for labour is likely to wane in some sectors as an expected recession will cool the appetite of firms to expand headcount.

Growing reluctance to invest and hire.

Firms are operating in an environment of rising borrowing costs, elevated cost pressure, weakening consumption and all-round heightened economic uncertainty. The growing consensus among firms is that the current climate is not ideal for expanding business. With a recession on the cards, the desire to invest understandably weakens. Today’s release showed that a net 28.4% of firms intend to pare back investment in plant and machinery. That’s a massive decline from Q3 and marks the  lowest reading since the June 2020 “lockdown” quarter. Plans to invest in buildings were especially dire, with a net 40% of firms paring back plans – the lowest reading since March 2009. It’s not surprising that the construction sector is the most pessimistic at present. Weak investment intentions only reinforce expectations of subdued near-term economic growth.

lowest reading since the June 2020 “lockdown” quarter. Plans to invest in buildings were especially dire, with a net 40% of firms paring back plans – the lowest reading since March 2009. It’s not surprising that the construction sector is the most pessimistic at present. Weak investment intentions only reinforce expectations of subdued near-term economic growth.

On labour demand, the tide looks to be (finally) turning. Employment demand has largely held up as the Kiwi economy recovered from the 2020 lockdown. But for the first time since June 2020, hiring intentions posted a net decline. That is, a net 6.3% of firms expect to reduce headcount in the coming months. That’s quite the reversal from Q3 when a net 9.6% were looking to increase headcount. Like investment intentions, the dimming economic outlook may explain the reluctance to hire. Weakening expected activity and profitability questions how much gas employment demand has left in the tank. If firms are expecting to pump out less output, then an extra pair of hands may prove unnecessary, and instead too costly.