Key spending insights

- The post-lockdown sugar rush has (finally) come to an end.

- Economic activity is unavoidably disrupted when restrictions are tightened.

- The long-awaited Aussie travel bubble will see many Kiwis leave, but more Aussies arrive.

- Adapting to the new way of working.

- Creaking the door open with travel bubbles.

Watch the report summery here.

Coming down from the spending sugar high

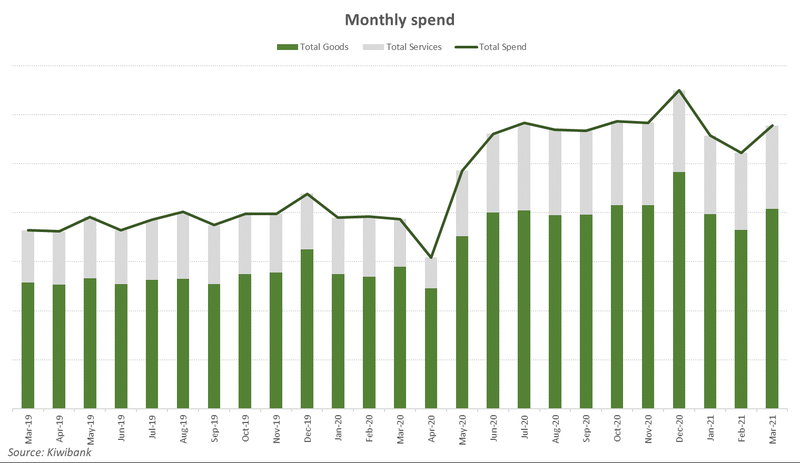

- The resilience of household spending has surprised us, and has been a key driver of the Kiwi economy’s post-lockdown recovery. The splurge in spending over the second half of last year lasted much longer than expected. But now we have seen a pullback.

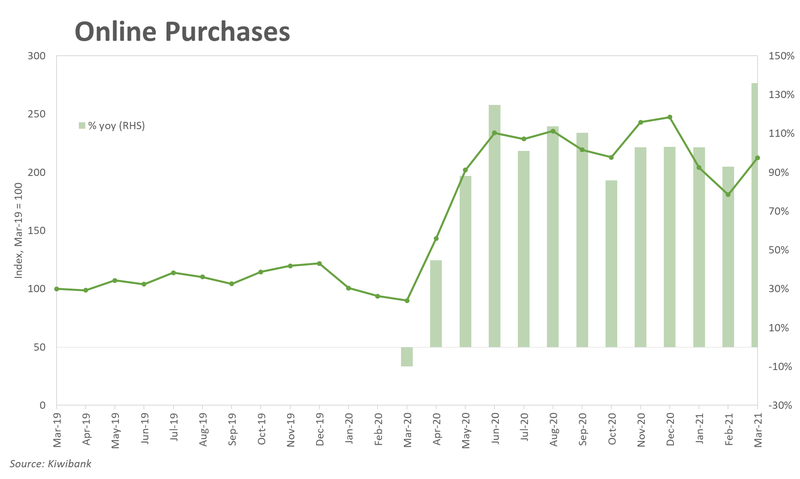

- Kiwibank’s transactional data suggests that the 2020 spending sugar rush might be coming to an end. Domestic spend declined 9% in the March quarter, the first time since the first lockdown ended. The buffer of household savings built up over the initial lockdown may be eroding. And digging through the details, most high-level spend categories were on a downtrend.

- Annually, spending is still up 41.8%, albeit likely inflated due to a structural shift away from cash as a means of purchase.

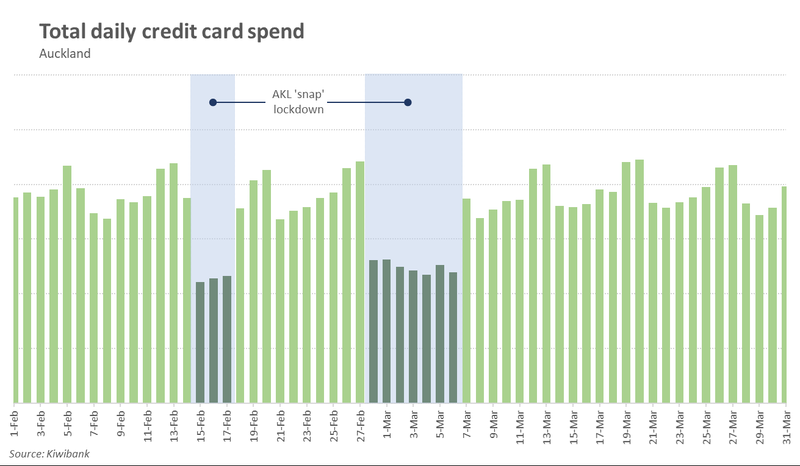

Auckland sails out of lockdown

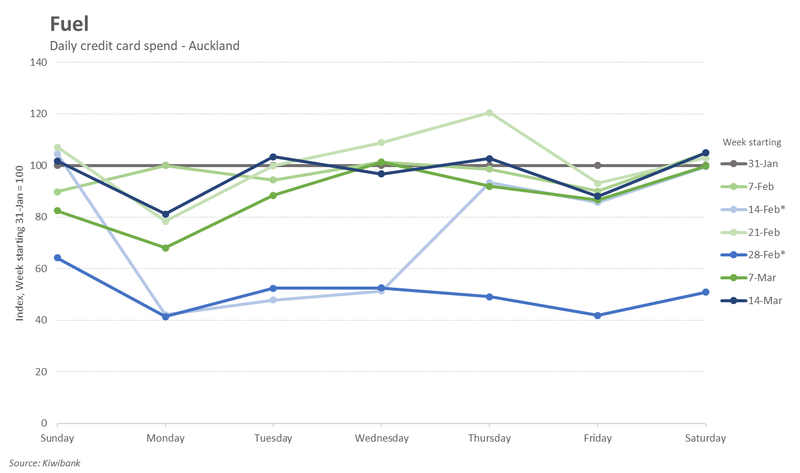

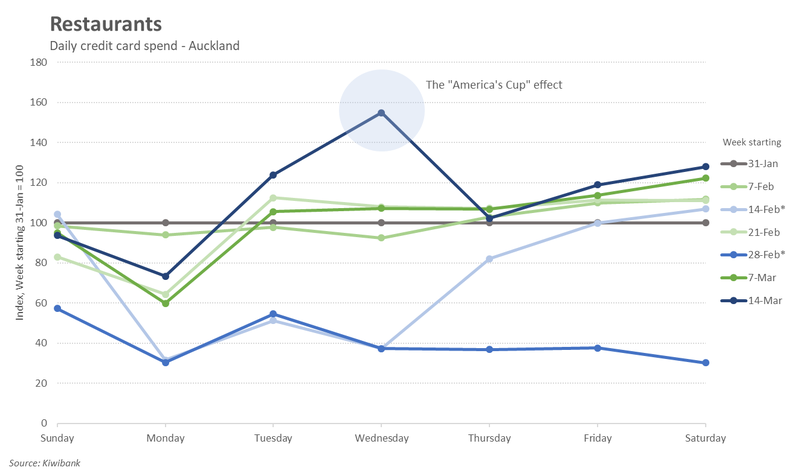

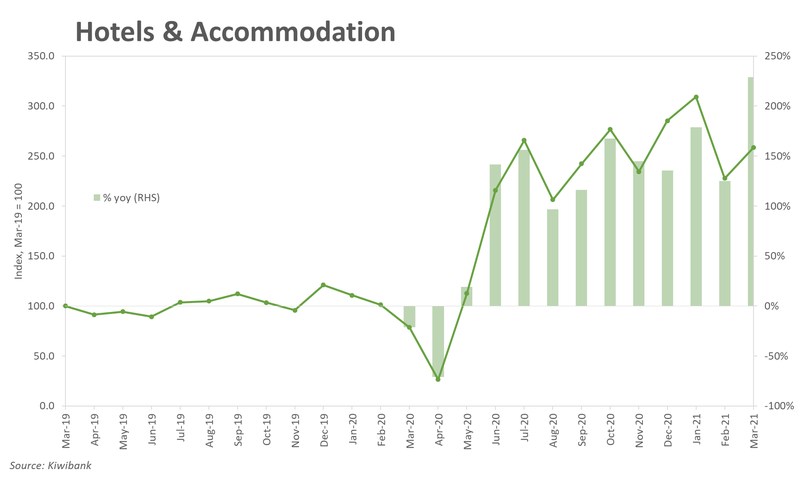

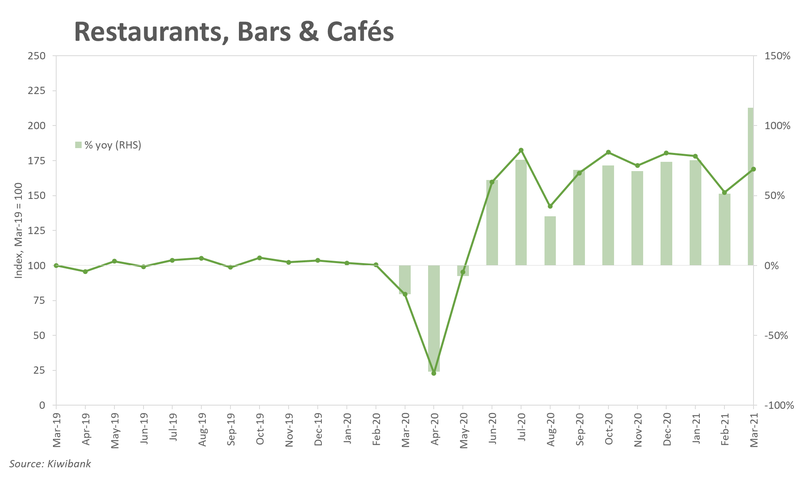

- Spend unavoidably took a hit when Auckland was twice put under level 3 lockdown. Restaurant spend plateaued, as ‘dining in’ was prohibited. Spending on fuel dropped as Aucklanders worked from home, and travel to the regions was limited to essential only. Spend has since bounced as Auckland bounced out of the Level 3 lockdowns. But many businesses in the CBD continue to struggle.

- The America’s Cup was a godsend for Auckland’s hospitality scene. Each race day, the viaduct was packed. And the final day of sailing saw a higher than usual restaurant spend for a Wednesday.

All done, now what?

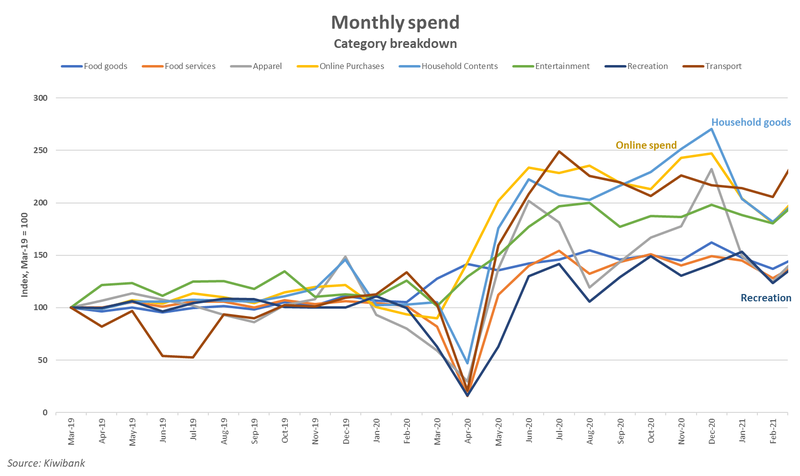

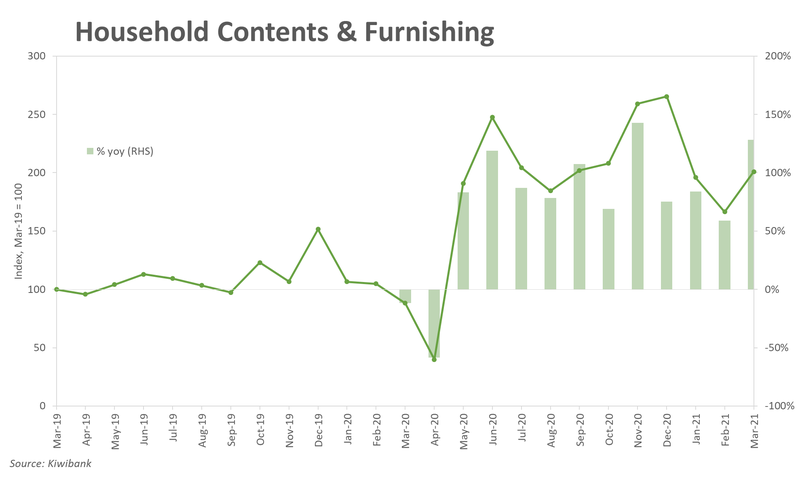

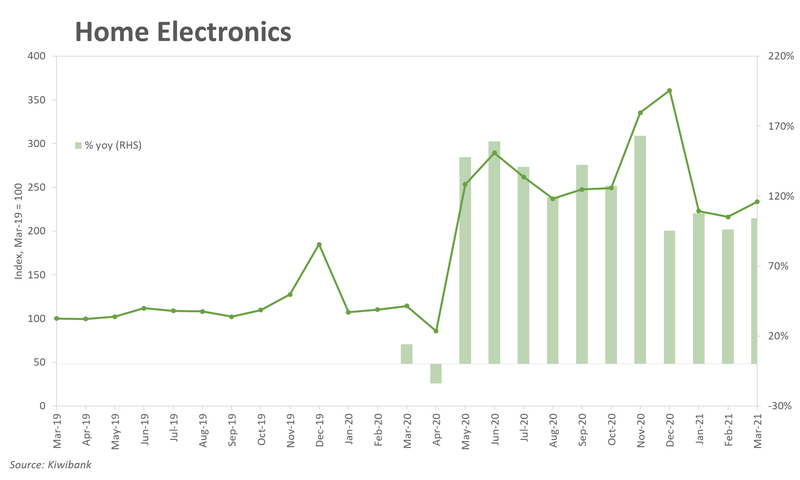

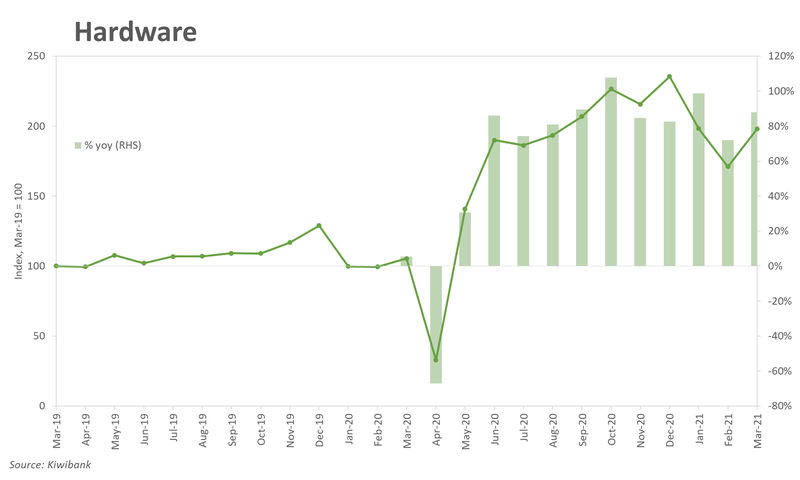

- There’s a limit to how many pools and pizza ovens can fit in the backyard, and after a year of repairs, there’s nothing left to fix. Demand for home furniture, electronics and hardware appears to have peaked in the December quarter. Household-related spend fell 21% in the March quarter.

- Prospects of a travel bubble may be spurring some to resume planning trips overseas. The decline in spend may suggest that some have begun filling up the jar once again, ready for when our door is creaked open.

The new way of working

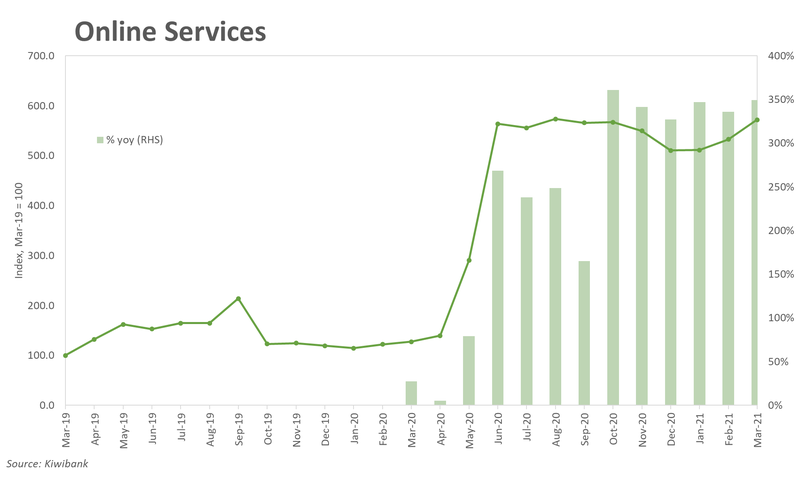

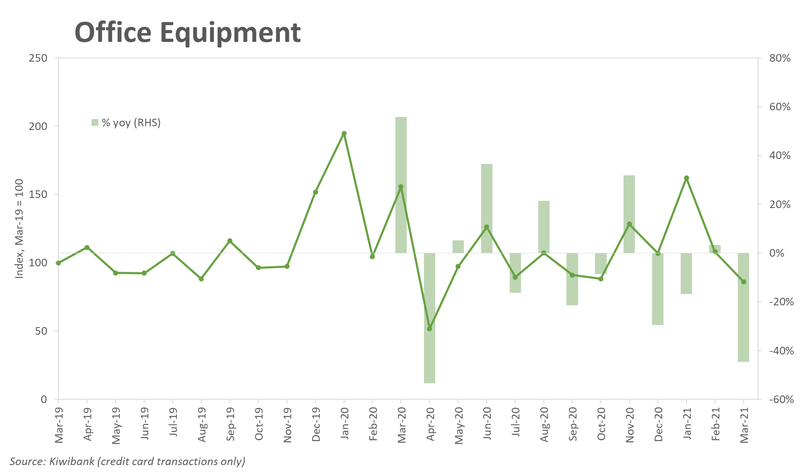

- The lockdown has opened up the world of working from home. One year later, and the WFH movement is here to stay. We may still be talking on mute and trying to keep our children out of frame, but we’re more productive with this new-found flexibility. Demand for online services, including Skype, remains elevated. Office equipment spend rose 51% in January as many geared up for a new year of a new way of working.

- We’ve also witnessed a tec(h)tonic shift toward digital commerce. A trend already in pace.

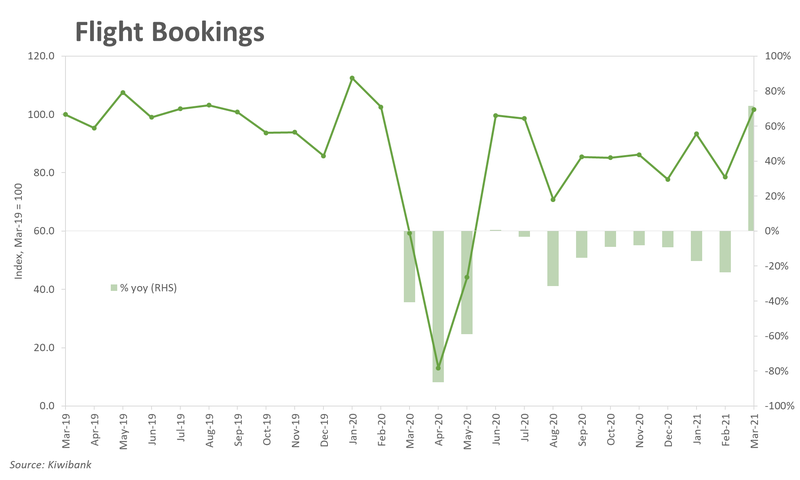

Flight mode switched off

- Domestic spend on hospitality and accommodation started 2021 strong as many of us were still on holiday. But we’ve since returned home and packed away the Xmas decorations. The Auckland lockdown may also have played a part, with domestic hospitality spend down in February. The tourism sector needs high value international tourists whose spend is not limited to the weekends and holidays.

- Official StatsNZ data reveals that hospitality spending was down 16% in Feb 2021, compared to Feb 2020, due to a lack of tourists.

Better late than never

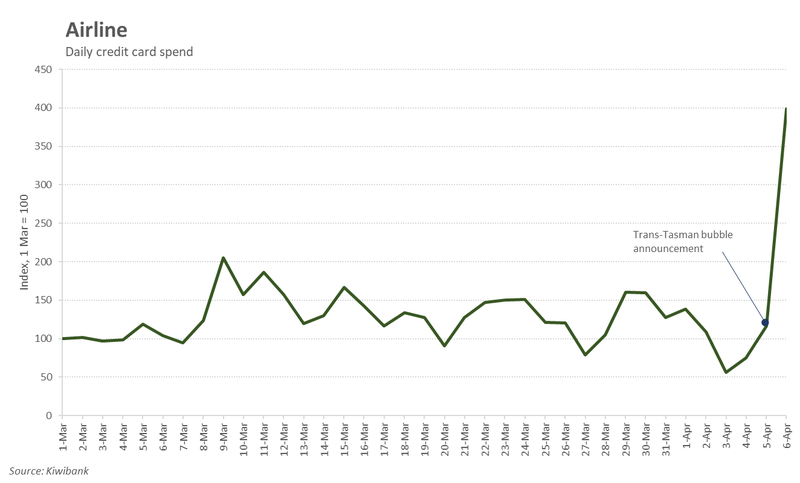

- Drawbridges on either side of the Tasman have been firmly upright for over a year. Naturally, there’s a lot of pent-up demand for overseas travel waiting to be released. Like Kiwi, many Aussies will relish an opportunity for a break across the ditch, to visit friends and family not seen since before Covid.

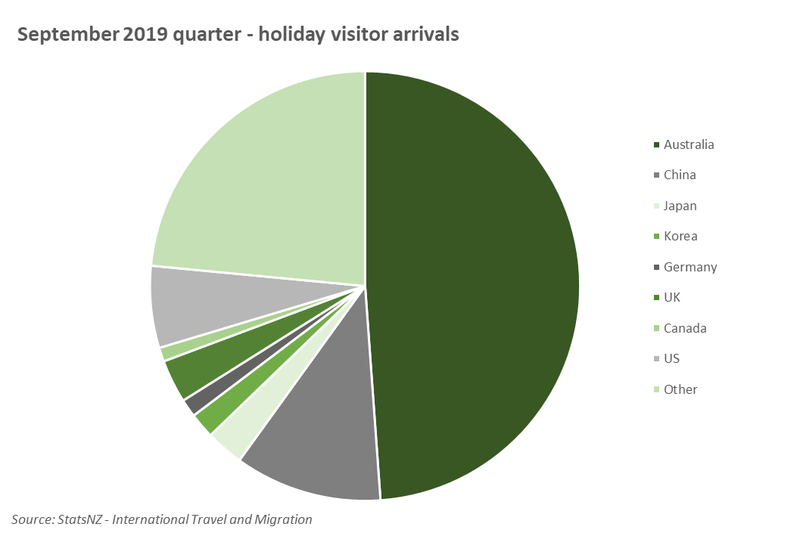

- Trans-Tasman travel is set to begin as of April 19. While an April travel bubble comes too late for the tourist summer season, it would provide some of our key tourist hotspots such as Queenstown, with hope as we head towards the ski season. And by country Australia is our largest tourist market by volume and total spend. In 2019, Aussies made up 40% of international visitors, with spend of $2.7bn.

- We expect some Kiwi to leave when the bubble is formed, especially if it is expanded to include the Pacific Islands. But the Kiwi economy, the travel bubble will be a net benefit.