The provinces continue to outshine Auckland

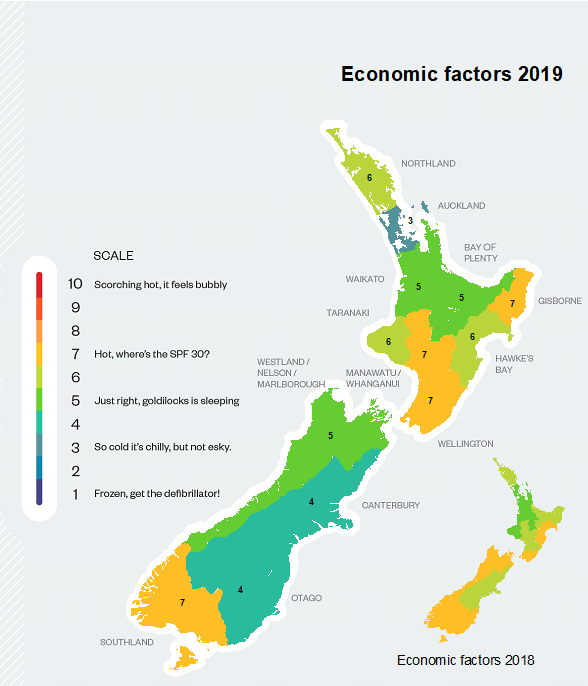

- The regions are cooling in line with slowing national GDP growth. Auckland and the South Island stand out as particularly anaemic parts of the country. Wellington is sitting high with a 7/10, defying the slowdown (for now).

- There’s a growing need for a stronger policy response from both the central bank and central government. We expect the RBNZ will deliver another 50bps cut to just 0.5%. And we wouldn’t rule out a 50bp cut in November.

- Not all regions are facing tough times. Some of our smaller regions, such as Gisborne and Whanganui/Manawatū have experienced a lift in their regional scores.

The regional heatmap has cooled, but it’s not all bad

We’ve updated our regional analysis. Compared to a few years ago, most regions have cooled along with national GDP growth. Last year, we highlighted the growing divergence in “The performance of the provinces: improves beyond Auckland”. The divergence has worsened this year, with Auckland stalling, as aggregate GDP growth has surprised us on the downside. The Kiwi economy recorded below trend growth of just 2.1%yoy in the June quarter, the lowest rate seen since 2013. Worryingly, businesses remain despondent, according to surveys, pointing to a further slowdown into 2020. The deterioration in business intentions demands a policy response, and we think the RBNZ will respond. We expect the RBNZ to cut to just 0.5%, and we may see another 50bp move in November.

Auckland typifies the slowdown in the regions, and the City of Sails is flailing in the wind. The Auckland housing market remains particularly soft, and many firms in the region highlight capacity constraints as impediments to growth. But there are signs that Auckland’s housing market is finally stirring, and where Auckland goes the rest of the country tends to follow. To give Auckland a chance, the policy response should not just come from the central bank. We also need central government to step-up and trim the main sail as the Super City heads towards hosting the next America’s cup. We need more infrastructure investment to lay the foundations for future growth across the country. Maybe the strong readings in Wellington have politicians thinking things are good. At least until they open a business confidence survey.

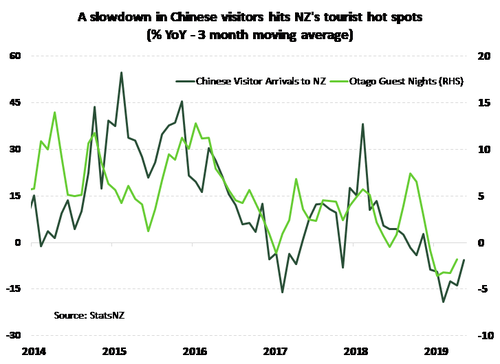

The South Island is also a concern. Apart from Southland, regional scores took a tumble this year. The downdraft has been seen in the NZIER’s business survey, with profitability and hiring sharply lower in the south over Q3. External forces are at play here, with guest nights falling in line with slower growth in tourist arrivals. But there remains opportunity for firms who look to invest. As our banker on the ground in Canterbury notes, “… business is there for those willing to go out and chase it.” – Grant McIntyre, Senior Commercial Manager. And we expect the RBNZ to lower the hurdle rates for business investment further to nudge more firms to take the plunge.

Fortunately, not all regions are experiencing tough times. Some of our smaller regions, such as Gisborne, Whanganui/Manawatū and Southland have maintained or even seen a rise in their regional score - which were already decent. Housing markets in these regions have surged as they catch up to the larger centres, and investors hunt for decent rental yield. Construction activity has responded and people in these regions seem generally happy to open their wallets and spend.

The Super City is super slow

The most shocking development compared to our last report is the fortune of our largest city. Auckland’s overall regional score has deteriorated a full 2 points from 5 to an anaemic 3! Leading Auckland lower was the housing market. The housing market has remained sluggish after peaking back in 2016. Home sales are bouncing along the bottom of recent ranges, and house prices are recording modest falls. These developments are translating into weaker construction activity. That’s not the same as saying construction activity is soft or falling. This is just evidence that the building sector remains at or near full capacity in Auckland. It’s harder to squeeze more out of the limited resources we have. This is the case for much of Auckland’s economic measures. Employment is growing around average, but average is weak compared to the boom of a few years’ ago.

The good news is there are some tentative signs that the falls in Auckland house prices have bottomed. Sales activity has started to lift in recent months, and this tends to lead moves in prices. Moreover, with the possibility of a CGT now taken off the table, there is less policy uncertainty for property investors to deal with. Finally, mortgage rates are falling thanks to the aggressive RBNZ cut in August, with more likely to come. Another positive for the Auckland region is population growth – in fact all regions continue to experience above trend population growth. Auckland is a magnet for migrants, and the gateway for many into the country. However, burgeoning population growth might not be a welcomed bright spot at present. Auckland’s infrastructure is creaking under the weight of rapid population growth, and decades of underinvestment. The harbour bridge was too small when first built, and it seems to look smaller every year. Sizable investment is desperately needed in our largest city. Looking ahead, our people on the ground have seen a notable lift in confidence, largely on the back of green shoots appearing in the housing market. “Auckland has the feeling of a rising swell of growth/confidence coming back to the region after 12-18 months of flat waves like a good East Coast Bays Beach!” Leon Bernie, Senior Commercial Manager. Confidence should also be supported as the City gears up for the America’s cup in a few years’ time.

Some of our smallest regions top the standings in 2019

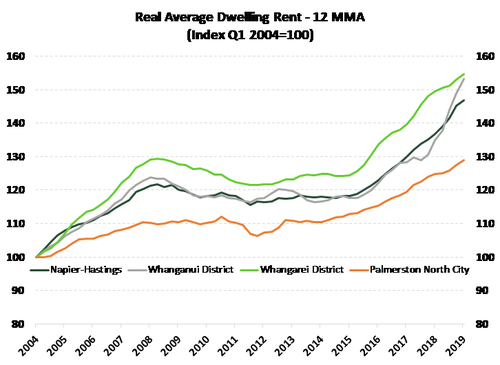

Sitting pretty this year are Gisborne (+1 to 7/10), Whanganui / Manawatū (+1 to 7/10) and Southland (unch at 7/10). The actual economic results better reflect the “feels like” eyechrometer scores from our local business bankers (see below). These regions are all experiencing buoyant housing markets from above average population growth and as the previous surge in housing seen in the main centres has trickled down to the extremities. Construction activity has responded. Gisborne and Southland recorded soaring building consents over the middle of the year. Auckland is clearly suffering from a severe shortage of affordable housing. But housing shortages are not simply confined to north of the Bombays. Signs of a shortage are evident in areas such as the Hawkes Bay with surging rental gains and property prices. There is also plenty of anecdotal evidence to suggest investors have been in these regions on the hunt for rental yield – which had been whittled away in the larger centres.

When the housing market is strong, households are usually more confident. The scores of these regions were in part supported by above average retail spending growth. Gisborne for instance, has experienced a rapid rise in retail sales over the first half of 2019, and sales were almost 8%yoy higher in the June quarter alone.

The mighty Manawatū has had a particularly solid run over the last year and “…the construction business in Whanganui is very buoyant with a good number of job advertisements” – Natalie Sara, Business Manager. The region is a major Defence Force hub and is set to be bolstered by the shift of new Airforce hardware to Ohakea in coming years. In addition, the Government has greenlighted the replacement to the Manawatū gorge road, a brand-new highway over the Ruahine range – a major piece of transport infrastructure for the lower North Island.

Wellywood is looking good

The Wellington region (unch at 7/10) stands out far in front of Auckland, Canterbury and Otago. Wellington looks to have benefited from consistency across most underlying measures. For instance, growth in employment, retail sales, and guest nights are tracking comfortably above average for the region. Like Auckland, Wellington is becoming a victim of its own success. The almost 40,000 people added (a 7.6% gain) to the region’s population between the 2013 and 2018 censuses has increased pressure on local infrastructure and the cost of housing. And the upbeat assessment may not last. On the ground, Wellington’s notorious gales must be adding a windchill factor. While the housing market remains solid, “…business confidence is certainly down over the last year” in part due to a “…lack of progress in recent years on critical infrastructure projects within the city” – Peter Charlesworth, Regional Manager.

Lower North Island holds well

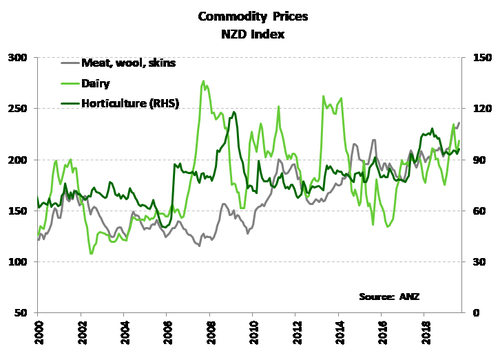

Not far behind the top regions were Taranaki (+1 to 6/10) and the Hawke’s Bay (-1 to 6/10). Taranaki faced a tough 2018, with the possibility of sharp falls in dairy prices, the Mycoplasma bovis disease knocking on the region’s door, the announcement from the Government banning future offshore oil and gas exploration, and the news that Yarrow Stadium was not up to code. But there has been a little more to smile about in 2019. Dairy prices have held up well despite growing concerns of an all our trade war between the US and China. According to our eyes and ear on the ground “…plenty of tourists are around and about spending their $$$’s” - Pippa Kohlhase, Bank Manager. And on the data front, annual employment growth in Taranaki hit a sizzling 8.2%yoy in the June quarter. Here’s hoping that employment growth stays elevated, given Taranaki posted the highest regional unemployment rate in the June quarter of 5.2%, well above the national rate of 3.9%.

Prices for key export commodities have generally held up well this year, particularly meat prices. China is facing the horror of African Swine fever, which has decimated its pig population. As a result, Chinese demand for imported proteins, to offset local loses, has surged. Adding a further a boost to the prices that NZ producers face has been a falling currency. The trade-weighted index (TWI), or the basket of currencies most important to NZ, is down around 5% from the March quarter. Resilient commodity prices have been great news for regions known for sheep and beef farming such as the Hawke’s Bay. And this also filters through the region by supporting incomes and spending.

Some evidence of Auckland spill over in the north

There is some, albeit limited, evidence that Auckland’s situation has spilled over to neighbouring regions. Although, scores in Northland (unch at 6/10), Waikato (unch at 5/10), and the Bay of Plenty (-1 to 5/10) did hold up much better than the City of Sails. A key similarity is population growth which is taking a toll on infrastructure. “…all this activity is putting pressure on infrastructure with roads getting jammed and a lack of development space for housing causing concern in the housing construction industries" – Kieran Mischewski, Commercial Manager. Also mirroring Auckland are the housing markets. And while we haven’t seen house price falls in places such as the Waikato, sales activity is broadly weak and helped to drag down these regional scores. But in contrast to Auckland, these regional neighbours have shown stout resilience in guest nights – encouraging for tourist meccas like Rotorua in the Bay of Plenty. Auckland may have suffered more by slowing tourist growth in 2019, particularly from the Chinese market.

The economic temperature drops in the south

Apart from Southland (unch at 7), there was a consistent deterioration in the regional scores of the South Island. NZIER’s business confidence survey echoed this picture. Business confidence has fallen through the floor, firms’ profitability is weak and South Island firms indicated they slashed headcount in the third quarter. In our analysis, we found that both Canterbury and Otago lost significant ground on last year falling 2 and 3 points respectively to a chilly 4/10. There was weakness across the board in economic measures. But a key concern seen was a fall in the number of guest nights in Otago, the Marlborough / Nelson / Westcoast and Southland – tourism being a vital industry across the South Island. This is consistent with a slowdown in short-term visitor growth from Chinese visitors. Related to weaker tourism activity is below par retail spending growth.

Canterbury and Otago recorded very modest rise in nominal retail spending in the middle of 2019, substantially below the rate of growth experienced only a few years ago. Construction activity looks to be soft down south too. While, building consents in Canterbury did post a 3.6%yoy rise in June, this is soft by recent standards. The Otago region posted a large fall in consents. We have heard anecdotes that the recent changes to ban foreign ownership of NZ property has hit the Otago Lakes district particularly hard. Moreover, housing affordability issues remain pertinent in this part of the country.

The feel good (or bad) factor

Again, we asked our Kiwibank business banking colleagues to get a sense of the regions at the coalface. Here is what they said:

Northland feels like 5, down from 6

Northland feels like 5, down from 6

“The residential market is still buoyant though it has softened from the halcyon period of 2017/18. Multiple projects underway in the tourism and industrial sectors to bring visitors and growth to the region, atop promises of investment from the Provincial Growth Fund. Business confidence is neutral with political and market uncertainty being negated by low cost of capital. Construction in the region continues to lead the way.” Clarc Morris, Area Manager, Whangarei Business Banking

Auckland feels a decent 6 but we’re not sure.

Auckland feels a decent 6 but we’re not sure.

Our largest city “feels like” 6 could be 4 with a big sneeze or could go to 8 with some government stimulus. “Auckland has the feeling of a rising swell of growth/confidence coming back to the region after 12-18 months of flat waves like a good East Coast Bays Beach! However, if another big construction company sneezes, Auckland could end up with a bad case of the man flu which could knock out a lot of good companies who service this sector. The flow on effect could be epidemic. Auckland needs to build on its reputation as an emerging global business destination and a major innovation hub, focusing on growth industries, skills, investment and high-value exports. This will help the region diversify our economy to insulate any downturn in other sectors.” Leon Bernie, Senior Commercial Manager– Auckland Business Banking

In Waikato the cow bells are ringing a 6 or 7

In Waikato the cow bells are ringing a 6 or 7

“Waikato is 7 and feels like a 6. Just like spring weather, conditions are patchy, with head winds. Farmers have a bit more to worry about than late nights watching the RWC & early morning milking with the effects of Mycoplasma Bovis, concerns about Fonterra, increasing compliance requirements (water and effluent), Labour issues and the banks from across the ditch are making things harder. The Waikato is not just dairy but other key contributors such as major infrastructure, health, and education have their own issues. Business confidence is lower, and owners are checking the forecast before going outside. Consumers are a bit grumpy too, with big ticket items, such as cars, being put on hold. On the positive, generally businesses are still achieving solid results. Interest rates are low which may help stimulate growth.” – Craig Morrison, Senior Commercial Manager, Waikato Business Banking

The Bay of Plenty “scores a busy 6”

The Bay of Plenty “scores a busy 6”

“Scores a busy 6 but there’s some funny looking clouds outside of the harbour. Tauranga has more cranes dotting its skyline than ever in its history, construction work is everywhere, businesses are coming into town and the roads are filling up with cashed up Aucklanders. Just out of town Kiwifruit is booming once more, the biggest problem is getting workers to pick the fruit. However, all this activity is putting pressure on infrastructure with roads getting jammed and a lack of development space for housing causing concern in the housing construction industries.” Kieran Mischewski, Commercial Manager, Rotorua Business Banking

“Rotorua continues to outperform in many economic indicators compared with the wider BOP and indeed New Zealand. The latest Infometrics data showed the Rotorua district economy put in a solid performance for the June 2019 quarter. Residential and non-residential consents and house prices lead the way for Rotorua compare to the BOP and New Zealand. The ‘key’ sectors for Rotorua continues to be Agribusiness, Forestry, Geothermal and Tourism. The latest population statistics highlight the continued increasing population base of the Rotorua District. The ‘big picture’ positives for Rotorua is the planned restoration of the Museum and the Howard Morrison Centre both sustaining damage from the earthquake. The Rotorua Lakefront Development of circa $40m, although contentious among local politicians, together with the Whakarewarewa Forest are expected to attract high-spend visitors to Rotorua.” Lloyd Upston, Business Manager, Tauranga

Gisborne “Scores a 7 with busyness everywhere”

Gisborne “Scores a 7 with busyness everywhere”

“Scores 7 with busyness everywhere. With the Provincial Growth Fund kicking in money resulting in previously mothballed industry restarting, along with new industries opening up. Gisborne is pumping along at a pace that this idyllic slice of NZ hasn’t seen for several years. Accommodation for visitors is a premium with short notice space hard to find as out of town workers come into the area to ply their trade. With a growing population off the back of increased work opportunities there is now a real shortage in housing, along with trades to build the housing needed. This means busy times and raising prices for those in a position to build or sell. The one concern is the current drop in log prices, but even that isn’t dampening the good vibes on Main Street.” Kieran Mischewski, Commercial Manager, Rotorua

The sun is shining 7 in ‘the bay’ (Hawke’s Bay)

The sun is shining 7 in ‘the bay’ (Hawke’s Bay)

“The residential property market remains upbeat, with demand still outstripping supply. A number of motels have been converted into emergency housing due to the rental property shortage, reducing the amount of ‘short-term-stay’ stock. Prices continue to rise. Commercial property development is buoyant, with forward pipelines fully loaded with construction work. Labour shortage still a seasonal issue for our horticultural industries. Pockets of the business economy doing well, but optimism is anecdotally starting to wane a little. Feels like 7/10 – the sun is shining!” Garth Duncan, Senior Commercial Manager, Hawke’s Bay

Taranaki “tracking at a 6 heading for an 8”

Taranaki “tracking at a 6 heading for an 8”

“Tracking at a 6, heading for an 8. An increase in customers wanting to bank NZ has seen huge lending growth over the last 12 months. Property values are still increasing and plenty of tourists are around and about spending their $$$’s in the Naki” – Pippa Kohlhase, Bank Manager, New Plymouth

Whanganui/Manawatū feels like 7, slightly softer than last year.

Whanganui/Manawatū feels like 7, slightly softer than last year.

But locals are beginning to get anxious with all the negative press offshore, and locally. “The mighty Manawatū is still very positive. A housing market that is performing extremely well is supported by substantial planned Government spending – specifically in the new road to replace the Manawatū Gorge, investment in both the Airforce in Ohakea and Linton Army Camp as well as Massey University looking at a significant spend. GDP growth for the region sits at 2.8% (year ending June) compared to the national average of 2.5%. On top of that population growth is the strongest it has been for 28 years.” Simon Lees, Commercial Manager, Palmerston North

“Outside investors and people moving into the region are putting pressure on housing stock – a lot more higher-end properties and buyers now in the market. Commercial Investors are purchasing properties at a lower yield with a number of first-time investors/baby boomers chasing a higher yield than what the Banks are paying [on deposits]. Business are still struggling to find good staff, the construction business in Whanganui is very buoyant with a good number of job advertisements.” Natalie Sara, Business Manager, Palmerston North

Wellington “feels like a 5”

Wellington “feels like a 5”

“Whilst the housing market remains strong, business confidence is certainly down over the last year. This follows national trends but also reflects the lack of progress in recent years on critical infrastructure projects within the city which are being highlighted as part of the upcoming council elections. Lots of talk and planning by the Council - but not much action. Commercial office space is limited following the [Kaikoura] earthquake with no real signs of new supply in the near future. Feels like a 5.” Peter Charlesworth, Regional Manager, Wellington

Blenheim and Nelson feel sunnier than a 5.

Blenheim and Nelson feel sunnier than a 5.

“Blenheim and Nelson lead sunshine hours. Nelson has overtaken Central Otago as the country's fourth-biggest wine producing region. House price rises. Sea level rises. Wine production rises. Hop production rises. Tasman Mako rise to top Premiership table. Pressure remains for housing as Tasman district and Nelson are the second and third least affordable regions respectively for home buyers in New Zealand. Nelson airport terminal upgrade continues adding value to region.” Craig Brixton, Area Manager, Nelson Business Banking

Christchurch feels an almost 7, the same as last year.

Christchurch feels an almost 7, the same as last year.

“Major infrastructure completions in the next year, including Southern motorway and Northern motorway and Convention Centre, are big positives. The business that the new Convention Centre will generate (100+ forward bookings already held) is a positive stimulus to the CBD core (hospo in particular). Metro Sports centre being built at present. The Stadium (covered!!!!) business case is being done and this will be built (admittedly a while away but still contributing to positive sentiment). The housing market seems slower, prices have stabilised, but property mags are very thin with supply – expect uptick for spring. Sections and houses continue to sell, and demand continues to surprise. CBD still undersupplied with houses / residents (8,000 pre-quake occupants, about 6,500 today). We are funding plenty of these and they continue to sell well.” Greg Bramley, Property Finance Manager Christchurch

“The region is ticking along nicely. General comments have been things have been a bit flat but seem to be okay moving forward. Most clients are trading well and generating good profits. Comments from exporters were that while the Australian market was slow they are seeing good forward workloads and feel positive about the future. Clients doing well are the ones that are being proactive and innovative, not sitting on their hands. They are investing in their business and seeing the results of this. Goes against the wider market feeling but the business is there for those willing to go out and chase it.” Grant McIntyre, Senior Commercial Manager, Christchurch

Risks to the regions are coming from all sides

Risks to the regions are coming from both offshore and at home. Locally, an extended period of depressed business confidence is weighing on actual business decisions. It started with a change in government and a period of heightened policy uncertainty. Depressed confidence has led to firms reining in investment and headcount. And there is an inability among firms to pass on rising costs to customers – hammering profit margins. The longer we keep our heads down, the worse the outlook will be for growth, inflation and employment. The RBNZ needs to act further, and we expect they will. But central government needs to step-up too. The Government is in an envious fiscal position with plenty of room to borrow and invest, and at record-low interest rates too.

Financial conditions have eased substantially following the RBNZ’s recent rate cuts. But credit conditions may tighten. In December we are expecting to hear the RBNZ’s final decision on its proposed bank capital requirement rules. Banks will be told to hold more capital against their lending to help the financial sector weather the toughest of financial storms. Bank funding spreads are likely to widen, and it may be harder for some sectors of the economy, such as agriculture to access credit.

Gale-like headwinds are blowing in from offshore, the US and China are still deeply involved in a trade war. Although they are at least willing to talk. In the meantime, global trade and growth among our major trading partners is slowing. For now, we are being partially protected by resilient commodity prices and a falling currency. But this may not last.